Gen X Talks Net Worth: A Look at the Financial Success of Gen X Talks

The financial landscape for Generation X is a complex mosaic shaped by pivotal economic events and unique challenges. As this cohort navigates the intricacies of wealth accumulation, understanding the factors influencing their net worth becomes crucial. Gen X Talks serves as a vital resource, offering insights into effective wealth-building strategies and the significance of financial literacy. However, the path to financial stability is not without its hurdles. What specific strategies have proven most effective, and how can Gen Xers optimize their financial futures amidst evolving economic conditions?

Understanding Gen X Financial Landscape

Understanding the financial landscape of Generation X requires an analysis of their unique economic experiences, which have been shaped by significant events such as the dot-com bubble, the 2008 financial crisis, and shifting job markets.

These factors have contributed to socioeconomic challenges that hinder effective retirement planning, leaving many Gen Xers grappling with uncertainties about their financial futures and the feasibility of achieving lasting economic independence.

See also: Gary and Daly Net Worth: How Much Are Gary and Daly Worth?

Key Factors Influencing Net Worth

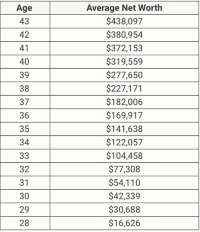

Several key factors significantly influence the net worth of Generation X, ranging from educational attainment and career advancement to economic volatility and personal financial decisions.

Career stability remains pivotal, as consistent employment fosters wealth accumulation.

Additionally, awareness of investment trends allows Gen X to make informed decisions, balancing risk and growth potential, ultimately shaping their financial trajectories and enhancing their economic freedom.

Wealth-Building Strategies for Gen X

Effective wealth-building strategies for Generation X encompass a diverse range of approaches, including strategic investment, proactive retirement planning, and prudent debt management, all aimed at fostering long-term financial stability.

By exploring diverse investment options—such as stocks, bonds, and real estate—Gen X can optimize their portfolios.

Additionally, early retirement planning ensures that financial independence becomes a tangible goal, empowering individuals to enjoy their desired freedoms.

The Role of Financial Literacy

Financial literacy serves as a crucial foundation for Gen X, enabling individuals to make informed decisions about investments, savings, and overall financial health.

By prioritizing financial education, this generation enhances their investment knowledge, empowering them to navigate complex markets and secure their financial futures.

Ultimately, fostering financial literacy not only promotes personal freedom but also contributes to the broader economic stability of society.

Conclusion

In conclusion, the financial journey of Generation X resembles a complex tapestry woven with threads of economic upheaval and resilience.

Navigating through turbulent markets has forged a generation adept at strategic investment and proactive planning.

As this cohort continues to cultivate financial literacy, the potential for enhanced net worth shines brightly, illuminating pathways to long-term economic independence.

By embracing diverse wealth-building strategies, Generation X can transform challenges into opportunities, ultimately crafting a robust financial legacy for future generations.